That said, there are some reasons to get a prepaid card. But they aren’t the same as credit cards and they don’t enjoy credit cards’ greatest advantage – the ability to help build your credit. Set your child’s secure PIN, and change it at any time within the app.Ī prepaid card is a great tool for someone who needs a little help budgeting, doesn’t have the best of credit or prefers the convenience of not always pulling out cash. Your Greenlight card comes equipped with an EMV chip which provides you an extra layer of protection and is required for many places around the world.

Set store-level and controls to make sure your kids only spend at certain stores, restaurants or websites.

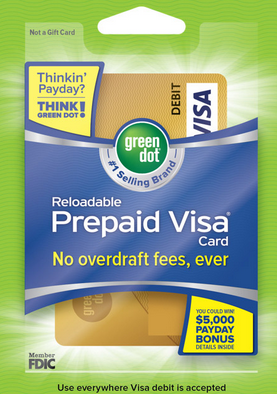

Teens can set up direct deposit and learn the importance of saving and giving. Pay once chores are completed, or tie weekly chores to allowance payments. Create one-time or weekly chores with flexible payment options. Set automated allowances that pay out on any day of your choosing, weekly, bi-weekly or monthly.*Visa's Zero Liability policy does not apply to certain commercial card and anonymous prepaid card transactions or transactions not processed by Visa. Unlike credit cards, prepaid cards don’t incur interest charges and don’t require a credit check to obtain. With prepaid cards, you’re spending money that has already been loaded onto the card. When you use a credit card you are borrowing money and building up a balance of debt you owe. And while Visa Prepaid cards are protected by Visa’s Zero Liability policy, * some prepaid cards have fewer consumer protections than debit cards, including those that apply if the card is lost, stolen, or other unauthorized charges appear. Overspending or overdrafts can occur in some cases where a prepaid card may be linked with a checking. In most cases, you can’t spend more money than you have already loaded onto your prepaid card. Then each purchase you make is deducted from that balance.

Instead, it is pre-loaded with a balance of funds. A prepaid card is not linked to a checking account.

0 kommentar(er)

0 kommentar(er)